Motley Fool Stock Advisor and TheStreet’s Action Alerts PLUS are two popular stock-picking services. They can help you find individual stocks that will outperform the broad stock market.

However, each service caters to a different investment strategy, has varying recommendation frequencies and provides different platform features.

This Motley Fool Stock Advisor vs. TheStreet’s Action Alerts PLUS comparison will help you choose the better investment service for your goals.

What is the Motley Fool Stock Advisor?

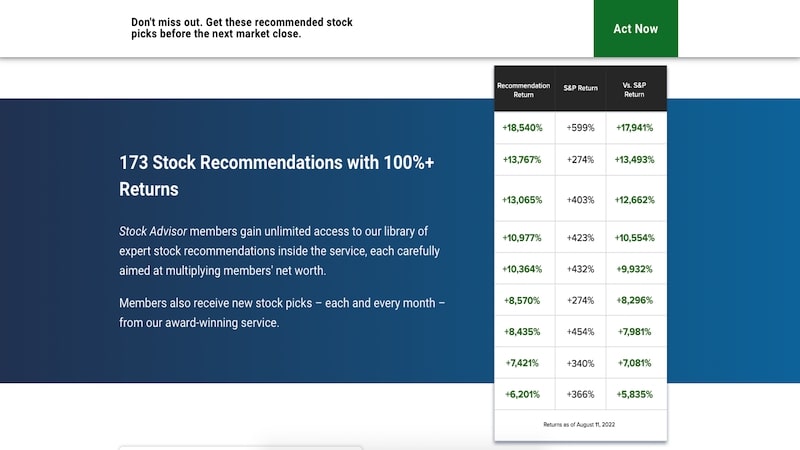

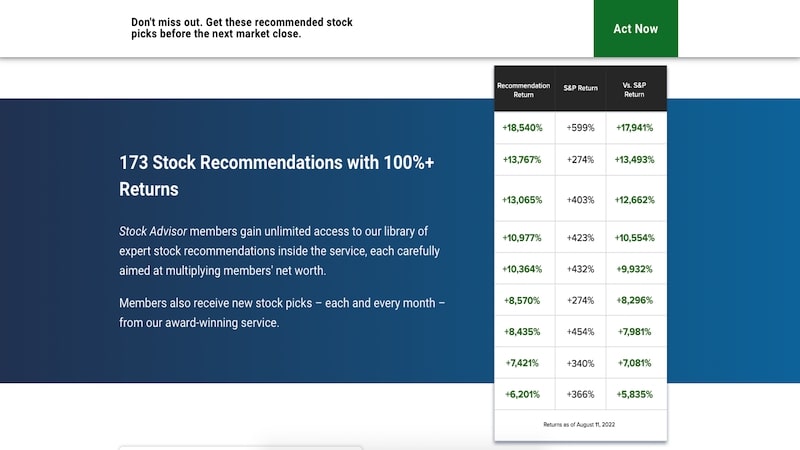

Motley Fool Stock Advisor is an entry-level investing newsletter that publishes two new stock recommendations each month along with constant portfolio updates.

You will receive suggestions from a variety of industries, including information technology, e-commerce and large-cap biotechnology.

However, you won’t see a model portfolio that tells you how much the company’s management team is investing in each recommendation. Instead, you decide a percentage of your portfolio to invest in each idea, if you decide to buy that particular stock.

The anticipated holding period for each recommendation is three to five years. This holding period is longer than most competing publications, including Action Alerts PLUS (AAP).

I like that The Motley Fool doesn’t require constant trading like AAP. As a parent and full-time worker, I don’t always have time to read multiple trade alerts each week and also want to minimize my selling frequency to avoid tax-reportable investment transactions that complicate tax prep.

Unique Features

Here are some of the best member benefits of a Stock Advisor subscription.

Current and Previous Tips

You have access to all active and closed stock recommendations since the service’s inception.

Each stock pick includes the investment performance along with a write-up to explain why the Stock Advisor team chose that stock at that particular time. I also like reviewing the reader-submitted questions and analyst video that accompany the stock pick release.

While you might focus on the newest recommendations since they can have the best potential for upside growth, the service also publishes a monthly “Top-Ranked Stocks” list.

The benefit of this list is that it highlights the top opportunities among all open recommendations with the best potential to beat the stock market.

No Stock Advisor recommendation includes a “buy up to” trading price or a stop-loss suggestion. This is because the service discourages timing the market and reacting to short-term price movements.

Instead, they focus on purchasing high-quality companies with share prices that can increase at a higher rate than the overall market.

You can gradually scale your portfolio as your budget and investing goals permit. I think this approach helps diversify your brokerage account responsibly and the asset allocation tool indicates which stocks have a cautious, moderate, or aggressive strategy.

Stock Advisor recommends holding at least 25 stocks for a diversified portfolio and a maximum asset allocation of 3% of your total portfolio balance.

Starter Stock Suggestions

In addition to the two monthly stock picks, the service provides a list of 10 Starter Stocks—also known as Foundational Stocks—that you can buy at any time to potentially improve your portfolio performance.

The service updates this list quarterly and suggests that new subscribers invest in at least two or three of these companies along with the monthly recommendations. Just make sure that your investments fit your strategy.

The Starter Stocks feature companies from a variety of industries that are usually a leader in their niche. I have found a few good investing ideas from this membership perk and it pairs well with the twice-monthly recommendations.

Since Stock Advisor may have originally recommended some of these stocks several years ago, they may not have as much growth potential as a new monthly pick.

However, Motley Fool still believes they can be a winning idea, and their investment performance might be less volatile than new recommendations.

Read our Motley Fool review to learn more about Stock Advisor.

What is Action Alerts PLUS?

Action Alerts PLUS (AAP) is the flagship investment newsletter run by TheStreet.

Expect multiple buy and sell recommendations each month for companies from all nine industries in the S&P 500 but with overweight exposure to industries with the best growth potential.

This service was founded by legendary CNBC analyst Jim Cramer. However, he stopped managing the portfolio a few years ago to focus on other endeavors.

Investors Bob Lang and Chris Versace oversee the model portfolio now. They blend technical analysis and fundamental research to recommend stocks as well as rebalance the portfolio.

This service has a more active investment strategy and a shorter holding period than Stock Advisor. It can be the better option if you’re comfortable making several trades per month.

I have subscribed to this service for several years and receive several trade notifications each week. That’s too frequent for some investors, but I think it’s a good balance between long-term and swing trading to take advantage of mid-term investment opportunities.

While this service utilizes more technical analysis than Stock Advisor, the AAP team tries to recommend stocks that you can hold for at least the next six to 12 months. In my experience, that’s usually the case although not every idea matches or outperforms the S&P 500 market returns.

As a result, it’s better for long-term investors than short-term traders who rely solely on chart analysis.

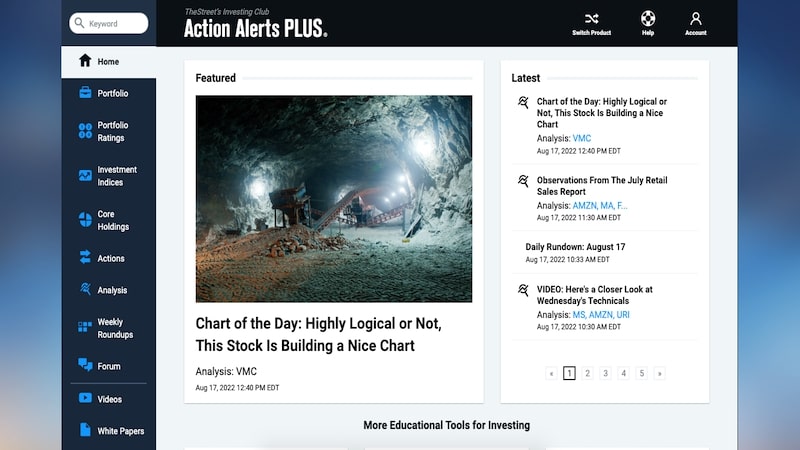

Unique Features

Action Alerts PLUS has a couple of unique features worth mentioning.

Conference Calls

You can call or stream a live monthly conference call. The primary focus of the call is an in-depth review of each portfolio holding.

The analysts also comment on some of the trends they’re watching for the next month and may answer some investor questions.

It’s possible to watch these videos on-demand if you can’t attend the live broadcast.

In addition to the monthly one-on-one calls, you will receive weekly portfolio updates and as-needed trading alerts. I like this hands-on resource because most investment newsletters don’t allow you to communicate directly with the analysts.

Model Portfolio

There are approximately 30 active recommendations that you might be ready to buy or put on your watchlist. You can view the list of recent trades and the investment performance for each recommendation.

To help you choose the best investment ideas, each holding has a buy rating.

The ratings include:

- Buy Now: Stocks we would buy right now

- Stockpile: Stocks that we’d buy on a pullback

- Holding Pattern: Consider selling this stock on strength

- Sell: Sell this stock as soon as possible

In addition to the open recommendations stock screener, you can see the closed positions, including the sell date. The portfolio managers may only sell a partial position to rebalance the portfolio.

A third portfolio section to check out is the Bullpen list of stocks the team is watching. Some of these companies may eventually receive a buy recommendation if the investment conditions improve.

For transparency, the AAP portfolio has underperformed its S&P 500 index benchmark (including dividends paid) for most years since its 2002 inception. This pales in comparison to Stock Advisor that has outperformed in most years.

Similarities

Stock Advisor and AAP share some similarities that make them extremely useful for investors.

Stock Recommendations

You will receive multiple buy recommendations each month from both services. They look for growth-focused companies that may also pay a dividend.

The company might be in the S&P 500 index. However, the recommendations are also likely to be other large-cap and mid-cap stocks with more long-term growth potential.

In time, these companies may eventually make it into the S&P 500, and you can enjoy their growth along the way before the S&P 500 index funds buy a position. I like that both services focus on well-known companies and industry leaders that can be tomorrow’s leaders.

Since these are both entry-level newsletters, you won’t be investing in obscure small-cap stocks that are very volatile and inherently riskier.

Both platforms recommend stocks with high liquidity and relatively stable share prices. You can buy these companies commission-free through most free investing apps.

These platforms let you interact with other subscribers using online forums. You can discuss recent trading alerts and other investing topics.

The discussions can help you gain a better understanding of why you might invest in a particular company or how it can be a good fit for your investing strategy.

This dialogue opportunity can provide additional value if you want hands-on guidance to potentially improve your research and buying process.

Educational Resources

You can also find basic educational tools that might help improve your investing skills. These resources can give you a better understanding of the newsletter’s investment philosophy.

Even if you’re an experienced investor, reviewing some of these resources can help you set up your investment portfolio and interpret the investment recommendations.

New investors can also find an investment glossary that defines basic investment terms.

You can even read stock market commentary on either website. Some of these articles discuss a specific active recommendation, while others focus on the broad market or an industry sector.

Customer Support

It’s easy to email customer support when you have questions about your subscription and need help navigating the online platform.

Action Alerts PLUS also offers phone-based support, although I’ve usually communciated by email.

Differences

Here are several of the ways that Stock Advisor and AAP are different.

Price

The price difference is notable for either service, as are the subscription options.

Motley Fool Pricing

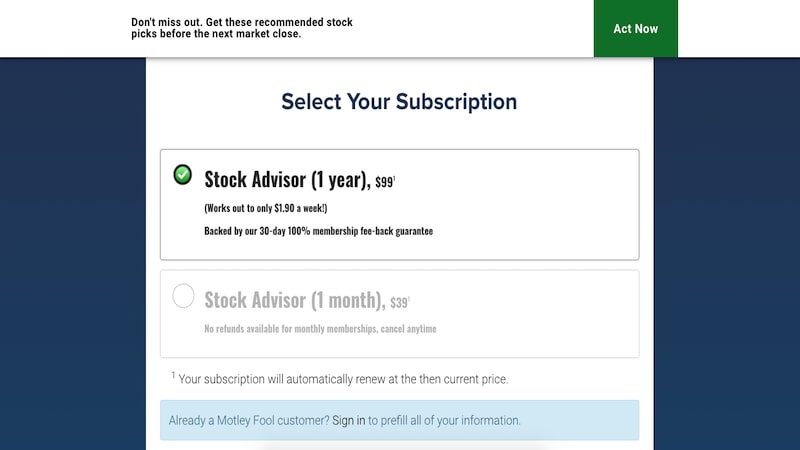

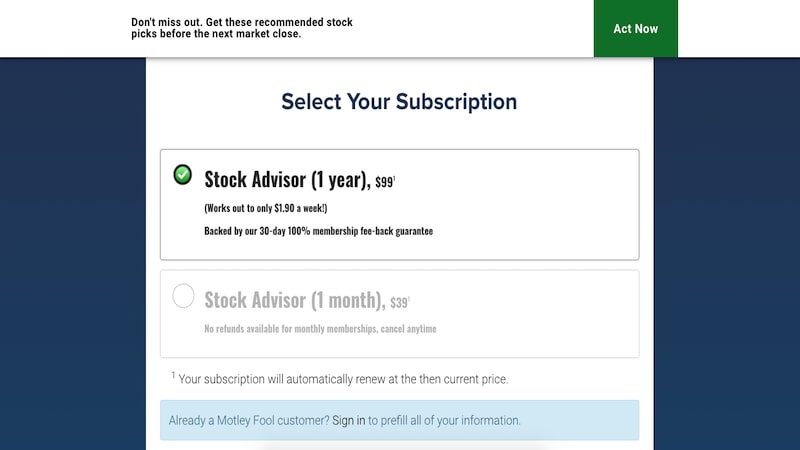

Stock Advisor is cheaper than Action Alerts PLUS. Your annual subscription is only $99 for the first year and $199 for each renewal.

While Motley Fool bills your payment card immediately, you get a 30-day risk-free trial period to request a refund if you don’t like the service.

There isn’t a monthly subscription option for Stock Advisor.

Action Alerts PLUS Pricing

The membership fee for AAP is now bundled into TheStreet Pro subscription:

- Monthly billing: $5 for the first month and then $99 per month

- Annual billing: $5 for the first month and then $984 per year ($82/month)

There isn’t a trial period but you can cancel anytime and receive a prorated refund.

A Pro subscription includes the following memberships:

- Action Alerts PLUS portfolio

- Daily diary

- Options indicators

- Sentiment indicators

- Trading activity monitor

This subscription is expensive but includes access to over 200 monthly trading ideas and 125 daily research articles from over investment professionals and former hedge fund managers.

Stock Suggestions

While there may be some overlap between the stock recommendations, both platforms have a different holding period.

Before investing in any suggestion, keep in mind that not every stock recommendation from any service will make money.

Stock Advisor Stock Suggestions

Stock Advisor recommends buying stocks with promising long-term fundamentals. The minimum holding period is three to five years under normal circumstances.

You will only see sell recommendations when the Motley Fool team believes it’s time to close your entire position. In comparison, AAP is more likely to recommend reducing your exposure to maximize short-term weakness or strength.

Periodically, Motley Fool advises selling a stock for a profit if the company receives a buyout offer, it will be difficult to continue outperforming the market or it’s simply a losing stock idea.

In addition to rarely receiving sell recommendations, Stock Advisor won’t recommend ETFs.

Action Alerts PLUS Stock Suggestions

AAP projects a holding period of six to 12 months for stocks and ETFs. However, it’s not uncommon for the core positions to have a multi-year investment horizon.

The advisory team uses a mixture of fundamental and technical analysis to recommend a buy, hold or sell rating.

Most of the recommendations are for individual stocks. Periodically, the team adds a sector ETF for more diversified exposure to an investing idea.

It’s also essential to note that many sell recommendations are only a suggestion to reduce your current position size.

For example, you might sell some of your shares after a recent runup to take some profits and invest the proceeds in a different stock that’s more likely to have strong gains.

This newsletter requires more portfolio maintenance. If you’re investing in a taxable brokerage account instead of a tax-advantaged IRA, your stock sales can be subject to taxation.

Access

AAP investors can interact with the portfolio managers in the online forum and monthly conference calls.

It’s difficult to directly communicate with the Motley Fool analysts as the forums are mostly conversations between individual investors.

However, you may have the chance to ask questions during the live video sessions where Stock Advisor announces the new monthly recommendations.

You can access both services from your computer or web mobile browser.

Who Is Each Service Best For?

Stock Advisor is best for long-term investors who want to make a minimal number of trades each month. In most months, you may only act on the two new stock recommendations.

However, the multi-year holding period can require a higher risk tolerance. This is because Motley Fool is more likely to ignore short-term price swings that may encourage you to rebalance.

Consider Action Alerts PLUS when you’re willing to buy and sell shares on a monthly basis. Depending on the macroeconomic conditions, some months will be busier than others.

Additionally, you may appreciate the weekly and monthly portfolio reviews that can provide more in-depth analysis than Stock Advisor.

Alternatives

Depending on your investment strategy and research needs, you may prefer these investment services instead.

Morningstar Investor

Morningstar Investor provides analyst reviews for stocks, ETFs and mutual funds. However, this service doesn’t provide focused monthly recommendations for a model portfolio like Stock Advisor or AAP.

Instead, you can find investment ideas by using the stock screener, reading market commentary articles and referring to stock and fund investment lists featuring investments with five-star ratings for certain categories.

This service also includes a portfolio x-ray tool that can rate your current holdings.

Read our Morningstar review to learn more.

Seeking Alpha

Seeking Alpha provides an abundance of market research articles for stocks and funds. You can read the bullish and bearish viewpoints for many investment ideas. A Premium subscription includes Quant Ratings and a personalizable stock screener for multiple investment strategies.

While this service doesn’t offer model portfolios, you can follow analysts that may share their portfolios. A paid subscription also lets you track their historical investment performance.

Read our Seeking Alpha review to learn more

Zacks

Zacks provides analysis for stocks and funds with its famous Zacks Rank. This score estimates how likely a stock will outperform the market for the next 30 days. Long-term investors can also enjoy the Focus List that ranks stocks the service believes will outperform the market for the next 12 months.

This stock screener can even make it easier to find investment ideas with select fundamental and technical metrics. In addition to the stock and fund rankings, you can read market commentary articles and analyst reports for a particular company.

Read our Zacks Premium review to find out more.

Summary

Motley Fool Stock Advisor and TheStreet’s Action Alerts PLUS provide multiple stock recommendations each month to help guide your investments.

While either service can make it easier to find winning investment ideas, you must compare your investing goals to the average holding period and the required portfolio maintenance.

The better option overall can be Stock Advisor as you will be selling stocks less frequently, and its annual subscription is more affordable. Still, both offer affordable first-month trial periods to find the perfect match for your investing style.

Source link