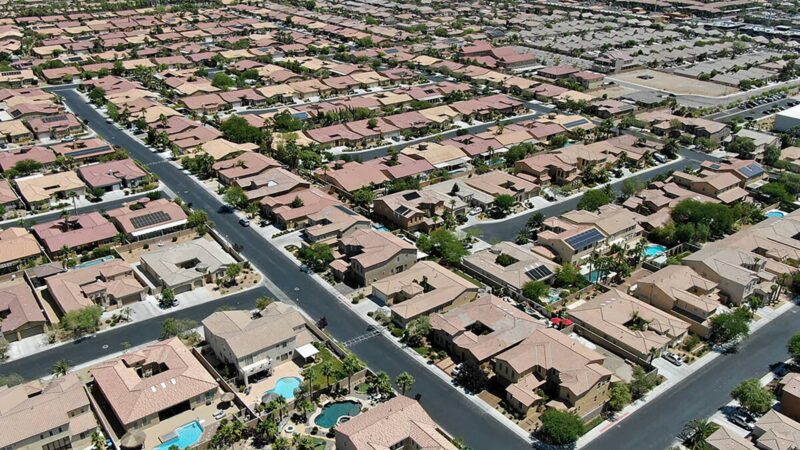

An exterior view of the Kohl’s store at the Paxton Town Centre near Harrisburg. A customer walks with a Nike shopping bag.

Paul Weaver | SOPA Images | Emily Elconin | Bloomberg | Getty Images

Nike and Kohl’s may not be winning on Wall Street, but a wide set of consumers still consider them to be the best in their categories, according to a consumer sentiment survey released Thursday.

The Consumer Sentiment Index from consulting firm AlixPartners asked 9,000 fashion shoppers from Gen Z to boomers about the factors that drive their purchasing decisions and how retailers stack up against their competitors.

Nike was ranked the No. 1 active footwear retailer among all four generational cohorts polled for the survey: Gen Z, millennials, Gen X and boomers. The legacy sneaker giant beat out Adidas and Foot Locker, which tied for second place, while upstart competitor On Running came in last among Gen Z and millennials.

Kohl’s was the No. 1 department store choice among Gen Z and boomers, while millennials chose Nordstrom and Gen X chose Macy’s.

The survey’s findings stand in contrast to Nike and Kohl’s recent performance. Nike is expecting sales to fall between 8% and 10% this quarter. As of Wednesday’s close, its stock is down 26% this year as investors brace for a long path to recovery under new CEO Elliott Hill.

Meanwhile, Kohl’s is expecting sales to fall between 4% and 6% this fiscal year as it grapples with the larger, existential issues facing department stores trying to remain relevant. Its stock is down 32% so far this year, as of Wednesday’s close.

Sonia Lapinsky, head of AlixPartners’ global fashion practice and the report’s author, told CNBC the survey’s findings – juxtaposed with the companies’ recent performance – indicate Nike and Kohl’s are at critical junctures. The results signal that consumers are still firmly behind the retailers, but that good favor could soon run out if they don’t quickly diagnose and fix what’s wrong.

“We would see in the data what’s important to the Nike consumer. It’s all about innovation, technical quality, product and [the competitors] who are growing super fast … they’re known for innovation, they’re known for product development, they do it a heck of a lot quicker than we know that Nike does it,” said Lapinsky.

She said it’s a similar situation at Kohl’s, which has changed its assortment strategy many times over the years, but has won consumers with competitive prices.

Consumers “still think they’re the best at product price combination. They’re still getting a deal. They probably love the Kohl’s bucks,” said Lapinsky. “Now let’s make the experience when they’re in the store something that they’re going to come back for and actually drive your top line.”

Walking the inventory tight rope

Alix’s consumer sentiment report revealed a host of other findings for retailers to keep in mind as they enter the ever important holiday shopping season, including the No. 1 factor that would drive shoppers to a competitor. The majority of consumers surveyed, or 66% of respondents, said they’ll shop at a different retailer if the product they’re looking for isn’t in stock.

“‘Right product, right place, right time’ echoes in every retail conference room, yet as retailers have expanded online assortments and marketplaces to attract new customers and traffic, it’s become more challenging to avoid frustrating shoppers when they can’t find their size or their desired item in-store,” the report said.

For example, only 9% of a retailer’s online assortment on average is available in stores, based on a sample set of 30 retailers, according to the report.

“It’s clear why consumers are frustrated. Macys.com has 24,000 women’s tops available online, but for customers who step foot in their Herald Square flagship in New York City, there are only 2,500 women’s tops available to pick up,” the report said. “For Gap.com, 158 tops and tees are available in women’s online, but only 50 are available for pick-up in the Herald Square location.”

As retailers look to stand out and attract attention online, they’ve started offering far broader digital assortments. But as consumers return to stores, they’re expecting to see those same products on the shelf.

It would be too expensive and unrealistic to replicate digital inventories in stores, so retailers need to be able to forecast which inventory to put where so consumers can find what they’re looking for in stores.

“This is a perfect kind of recipe for where AI should come in,” said Lapinsky. “They’ve got to get really smart about where the customer is going and what they’re looking for, and they do that with better analytics, potentially AI models, that are predicting what the customer wants. And then they’ve got to have that same view transition to stores, even by store location, store cluster, store region, where they have a good view of what that consumer is likely looking for.”

Source link