Are you looking for ways to invest your money wisely? Investing is an essential component of personal finance and can help you achieve your financial goals faster. Whether you want to retire early, buy a house, or pay for your child’s education, investing can help you get there.

However, with so many investment options available, it can be overwhelming

to know where to start. That’s why we have compiled a list of 10 smart ways to

invest your money today. These strategies have been proven to generate significant

returns and help you achieve your financial objectives.

In this article, we will take a closer look at each of these 10 investment

options, exploring their benefits, risks, and how to get started. By the end of

this post, you will have a better understanding of the different investment

opportunities available and how they can help you build wealth over time.

So, whether you are a beginner or a seasoned investor, let’s dive into the

world of smart investing and discover how you can make your money work for you.

10 Clever Ways to Invest Your Money Today

#1. Build an Emergency Fund

One of the first things you should do when investing your money is to build an emergency fund. An emergency fund is a separate account that is used to cover unexpected expenses such as medical bills, car repairs, or job loss. It acts as a safety net and can prevent you from falling into debt when faced with unexpected financial challenges.

Building an emergency fund requires discipline and consistency. Start by setting a savings goal, such as saving three to six months’ worth of living expenses. Next, create a budget and allocate a portion of your income towards your emergency fund each month. You can automate this process by setting up automatic transfers from your checking account to your emergency fund savings account.

It is important to keep your emergency fund in a separate account from your

other investments to avoid dipping into it for non-emergency expenses. Consider

opening a high-yield savings account or a money market account to earn interest

on your emergency fund while keeping it easily accessible.

Having an emergency fund can provide peace of mind and financial security in

uncertain times. It can also prevent you from having to take on high-interest

debt to cover unexpected expenses. Start building your emergency fund today,

and you will be one step closer to achieving your financial goals.

#2. Pay Off High-Interest Debt

If you have high-interest debt, such as credit card debt, it’s important to prioritize paying it off before investing your money elsewhere. High-interest debt can accumulate quickly and cost you a significant amount of money in interest payments over time.

One strategy for paying off high-interest debt is the debt avalanche method. This involves prioritizing debts with the highest interest rates and paying them off first, while making minimum payments on other debts. By doing this, you can save money on interest payments and pay off your debt faster.

Another strategy is the debt snowball method. This involves paying off debts with the smallest balances first, while making minimum payments on other debts. This method can provide a sense of accomplishment as you pay off smaller debts, which can motivate you to continue paying off larger debts.

Whichever method you choose, it is important to be consistent and make

payments on time. Consider setting up automatic payments or reminders to ensure

that you don’t miss any payments.

Once you have paid off your high-interest debt, you can redirect the money you were using to make debt payments towards investments. Not only will you be debt-free, but you will also have more money to put towards your financial goals.

Paying off high-interest debt may not be the most exciting investment

strategy, but it can provide significant returns in the long run. By

eliminating debt and freeing up money for investments, you can set yourself up

for financial success.

#3. Contribute to Retirement Accounts

Investing in retirement accounts, such as a 401(k) or

IRA, is an excellent way to save for retirement while minimizing your tax

liability. These accounts offer tax benefits that can help your money grow

faster than in a traditional savings account.

If your employer offers a 401(k) plan, consider contributing enough to take

advantage of any matching contributions. This is essentially free money that

can help your retirement savings grow even faster. If your employer doesn’t

offer a 401(k) plan, or if you want to supplement your retirement savings,

consider opening an IRA.

With a traditional IRA, your contributions are tax-deductible, which means

you can lower your taxable income and potentially receive a tax refund. With a

Roth IRA, your contributions are not tax-deductible, but your withdrawals in

retirement are tax-free.

It is important to start saving for retirement as early as possible to take

advantage of compound interest. Even small contributions can add up over time,

so don’t be discouraged if you can only contribute a small amount at first.

If you are self-employed or a small business owner, consider opening a Solo

401(k) or SEP IRA, which offer similar tax benefits as a traditional 401(k) or

IRA but are designed for individuals with self-employment income.

Contributing to retirement accounts is a smart investment strategy that can

help you build wealth and secure your financial future. Take advantage of these

tax-advantaged accounts and start saving for retirement today.

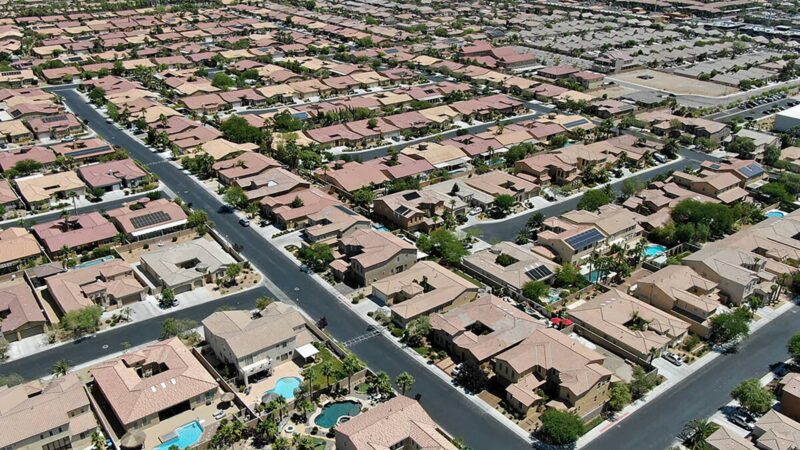

#4. Invest in Real Estate

Investing in real estate can be a great way to diversify your portfolio and build long-term wealth. Real estate can provide a steady stream of passive income through rental properties or can appreciate in value over time, providing a substantial return on investment.

One way to invest in real estate is to purchase rental properties. This

involves buying a property, such as a house or apartment building, and renting

it out to tenants. Rental income can provide a consistent source of passive

income, while property value appreciation can provide a significant return on

investment over time.

Another way to invest in real estate is through real estate investment

trusts (REITs). A REIT is a company that owns or operates income-producing real

estate, such as apartment buildings, hotels, or commercial properties.

Investing in a REIT can provide exposure to real estate markets without the

hassle of managing properties yourself.

If you are interested in investing in real estate, it is important to do

your research and understand the risks and potential rewards. Real estate

investments require significant upfront costs, such as down payments and

closing costs, and may require ongoing expenses, such as property maintenance

and repairs.

However, real estate can be a lucrative investment if done correctly. By

investing in properties with potential for rental income or value appreciation,

you can build long-term wealth and achieve financial

independence.

Investing in real estate may not be suitable for everyone, but for those

with the necessary funds and willingness to take on the associated risks, it

can be a smart investment strategy that can provide rewarding returns over

time.

#5. Invest in the Stock Market

Investing in the stock market can be a great way to build wealth over time. While stocks can be volatile in the short-term, they have historically provided strong returns over the long-term.

One way to invest in the stock market is to purchase individual stocks. This

involves buying shares of a company’s stock, which represents partial ownership

of the company. When the company performs well, its stock price may increase,

providing a return on investment. However, individual stocks can be risky and

require significant research and analysis to make informed investment

decisions.

Another way to invest in the stock market is through mutual funds or

exchange-traded funds (ETFs). These are diversified portfolios of stocks that

are managed by professionals. By investing in mutual funds or ETFs, you can

spread your investment across a range of companies and industries, reducing the

risk of investing in individual stocks.

When investing in the stock market, it is important to have a long-term

perspective and to avoid making decisions based on short-term market

fluctuations. Consider investing in a mix of stocks and bonds to reduce risk

and provide a more stable return on investment.

It is also important to do your research and understand the risks associated with investing in the stock market. Consider working with a financial advisor to develop an investment strategy that aligns with your goals and risk tolerance.

Investing in the stock market can be a smart investment strategy that can

provide significant returns over time. With careful research and a long-term

perspective, you can build wealth and achieve your financial goals through

stock market investments.

#6. Invest in a Business

Investing in a business can be a great way to build wealth and potentially earn a high return on investment. However, investing in a business can also be risky and requires careful research and analysis.

One way to invest in a business is to provide funding in exchange for

ownership or equity in the business. This is known as angel investing and

typically involves investing in startups or small businesses that have high

growth potential. While angel investing can be risky, it can also provide a

significant return on investment if the business succeeds.

Another way to invest in a business is to purchase existing businesses or

franchises. This involves buying a business that is already established and

generating revenue. While purchasing an existing business can be expensive, it

can also provide a more stable return on investment compared to investing in

startups.

If you are interested in investing in a business, it is important to do your

research and understand the risks and potential rewards. Consider working with

a financial advisor or business consultant to evaluate potential investments

and develop an investment strategy.

Investing in a business can be a smart investment strategy that can provide

significant returns over time. With careful research and analysis, you can

identify promising investment opportunities and potentially build long-term

wealth through business investments.

#7. Invest in Yourself

Investing in yourself can be one of the most valuable investments you can

make. By developing new skills, improving your knowledge, and investing in your

own personal growth, you can increase your earning potential and improve your

quality of life.

One way to invest in yourself is to pursue education and training. This can include earning a degree or certification, attending workshops and conferences, or taking online courses. By investing in education and training, you can gain new skills and knowledge that can make you more marketable to employers and potentially lead to higher-paying jobs.

Another way to invest in yourself is to focus on your physical and mental

health. This can include regular exercise, healthy eating habits, and

stress-reducing activities such as meditation or yoga. By investing in your

health, you can improve your overall well-being and potentially reduce

healthcare costs in the long run.

It is also important to invest in your relationships and personal

development. This can include spending time with loved ones, volunteering in

your community, or pursuing hobbies and interests that bring you joy. By

investing in your relationships and personal development, you can improve your

overall happiness and life satisfaction.

Investing in yourself may not provide immediate financial returns, but it

can have a significant impact on your long-term earning potential and overall

quality of life. By making personal growth a priority, you can improve your

skills, knowledge, health, and happiness, potentially leading to a more

fulfilling and prosperous life.

#8. Invest in Art, Collectibles, or

Antiques

Investing in art, collectibles, or antiques can be a unique and potentially lucrative investment strategy. These assets can appreciate in value over time and provide a tangible and enjoyable asset to own.

Art is one popular investment option, with some pieces selling for millions

of dollars at auction. Investing in art requires significant knowledge and

expertise, as well as an eye for quality and potential value. Consider working

with a professional art advisor or attending art auctions to learn more about

the art market and identify potential investment opportunities.

Collectibles and antiques can also be valuable investments, particularly if

they are rare or have historical significance. Items such as rare books,

vintage cars, and sports memorabilia can appreciate in value over time,

particularly if they are well-preserved and in high demand among collectors.

When investing in art, collectibles, or antiques, it is important to do your

research and understand the market for these assets. Consider working with a

professional appraiser or collector to evaluate potential investments and

develop a strategy for acquiring and selling these assets.

Investing in art, collectibles, or antiques can be a unique and potentially

lucrative investment strategy. With careful research and analysis, you can

identify valuable assets and potentially build wealth over time through these

investments.

#9. Invest in Education

Investing in education can be a powerful way to improve your career

prospects and increase your earning potential over time. Whether you are

pursuing a degree, attending a vocational school, or taking online courses,

investing in education can provide long-term benefits and potentially lead to

higher-paying jobs.

One popular way to invest in education is to earn a degree or certification.

A higher education degree can provide valuable skills and knowledge that can

make you more marketable to employers and lead to higher-paying jobs. Consider

researching in-demand fields and choosing a degree program that aligns with

your career goals.

Another way to invest in education is to attend vocational schools or

training programs. These programs can provide specialized training in fields

such as healthcare, technology, and skilled trades, and can lead to well-paying

jobs with less time and financial investment than traditional degree programs.

Taking online courses or attending seminars and workshops can also be a valuable

way to invest in education. These options allow you to learn new skills and

knowledge on your own time, often at a lower cost than traditional degree

programs.

Investing in education may require a significant financial and time

investment, but it can provide a high return on investment in terms of

increased earning potential and career opportunities. By choosing an education

path that aligns with your career goals and interests, you can potentially

build a successful and fulfilling career.

#10. Invest in Cryptocurrencies

Cryptocurrencies, such as Bitcoin and Ethereum, have emerged as a popular investment option in recent years. These digital assets use blockchain technology to enable secure and anonymous transactions, and their decentralized nature allows for greater transparency and security compared to traditional currency.

Investing in cryptocurrencies can be a

high-risk, high-reward option. Cryptocurrencies are highly volatile, with

prices fluctuating rapidly based on market demand and other factors. However,

for those willing to take on the risk, investing in cryptocurrencies can

provide significant returns.

One way to invest in cryptocurrencies is to buy and hold them for the long

term. This strategy involves purchasing a cryptocurrency such as Bitcoin and

holding it for an extended period of time, potentially years or even decades,

in the hopes that its value will increase over time.

Another way to invest in cryptocurrencies is to trade them actively, buying

and selling them based on market trends and technical analysis. This strategy

requires a deep understanding of the cryptocurrency market and significant time

and effort to monitor and analyze trends.

When investing in cryptocurrencies, it is important to do your research and

understand the risks involved. Cryptocurrencies are still a relatively new and

unregulated asset class, and their value can be impacted by a range of factors,

including government regulation and security breaches.

Investing in cryptocurrencies can provide significant returns, but it

requires careful consideration and a willingness to take on risk. By staying

informed and understanding the market, you can potentially build wealth over

time through cryptocurrency investments.

Final Thoughts – Ways to Invest Your Money

Today

Investing your money can be a powerful way to achieve financial freedom and

secure your future. With a wide range of investment options available, there

are opportunities for everyone to invest their money today.

However, it is important to remember that investing comes with risks, and

not every investment will be a success. To mitigate these risks, it is

important to do your research and understand the investment options available

to you. Consider seeking professional advice or joining an investment community

to stay informed and make informed decisions.

Ultimately, investing is a long-term game, and it’s important to be patient

and persistent in your investment strategy. By diversifying your portfolio and

staying focused on your financial goals, you can potentially build long-term

wealth and achieve the financial freedom you desire.

Source link